Are Watches an Investment Asset? Part II

In the 1st article we reviewed some of the factors that contributed to watch collecting and watch investing to gain tremendous popularity. The initial question was if watches could be considered an investment asset. So, in this second part, we will try to answer that.

Evaluating wristwatches as an investment asset

Then, it seems we cannot categorise watches as an investment asset, at least strictly financially. So, even though evaluating watches as a non-conventional asset seems “abstract” we will try to approach it differently by looking at 4 factors: Ease to liquidate, Demand, Risks and Performance.

- Ease to liquidate: How could someone think that selling a valuable watch is as simple as selling an Amazon stock option? Well, sought after models (if priced appropriately) can be sold within one day or even hours and the transactional process is sometimes quicker and more smooth than a real estate transaction, for instance. It must be taken into account that there is a growing secondary market for preowned watches, which is projected to soon surpass first-hand sales. The secondary market currently makes roughly 50% of the primary one but a report by the Swiss LuxeConsultpredicts it will grow to the €80B figure by 2033. For reference, in 2022, the pre-owned sales rose by 20% to €25B while new watch sales “only” climbed 12% to €52B.In short, analysts actually believe people will soon buy more old watches than new ones, suggesting that watches are highly liquid assets.

- Demand: Another factor that would discourage anyone from using the term’ investment’ is the fluctuating demand due to trends and fashion. An investment based on a celebrity wearing a specific model cannot be a clever nor a reputable decision because styles or trends evolve rapidly and unpredictably. What’s ‘hot’ in demand today can become obsolete tomorrow. But think about it…Why have watches performed so well in recent years or why is the preowned market growing so quickly? It is not solely about trends. The demand for rare, hard-to-get, or high-end timepieces has far outstripped the manufacturing supply. Production slowdowns, limited runs and low production models have resulted in annoying, multiple-year long wait lists. As a result, collectors and investors now increasingly turn to the secondary market to pick up sought-after pieces at a hefty premium fee over retail prices.

- Risks: Two interrelated risks should be considered when entering this market. Firstly, acquiring fashion-related items just because their price may be increasing due to scarcity is not a prudent financial strategy, as one cannot estimate the lifespan of trends or demand. On the other hand, developing a repeatable strategy or methodology for finding (and being able to buy at retail) the very specific models that will beat the traditional Stock Market long-term is really, really hard as it is almost impossible to have or acquire a very profound knowledge about the evolution of fashion over multi-decade periods.

- Performance (high-level market overview): While the market value of many watches have been falling in 2023, the going rate on the secondary market is still well above retail prices.Historically, high-end watches have performed well in comparison with traditional categories. From August 2018 to January 2023 (see picture below), the average prices in the secondhand market for top models rose at 20%, despite market downturns compared with the 8% by the S&P 500.

Performance of the worlds’ top 3 brands and overall brands average in comparison to S&P500 Index from BCG Report: Luxury Preowned Watches, your time has come

Performance of the worlds’ top 3 brands and overall brands average in comparison to S&P500 Index from BCG Report: Luxury Preowned Watches, your time has come

We recommend platforms like Watch Analytics or Watch Charts to find the most accurate market values as it helps establishing a benchmark for fair buying prices. They provide historical data that also help to assess short-term and long-term risk.

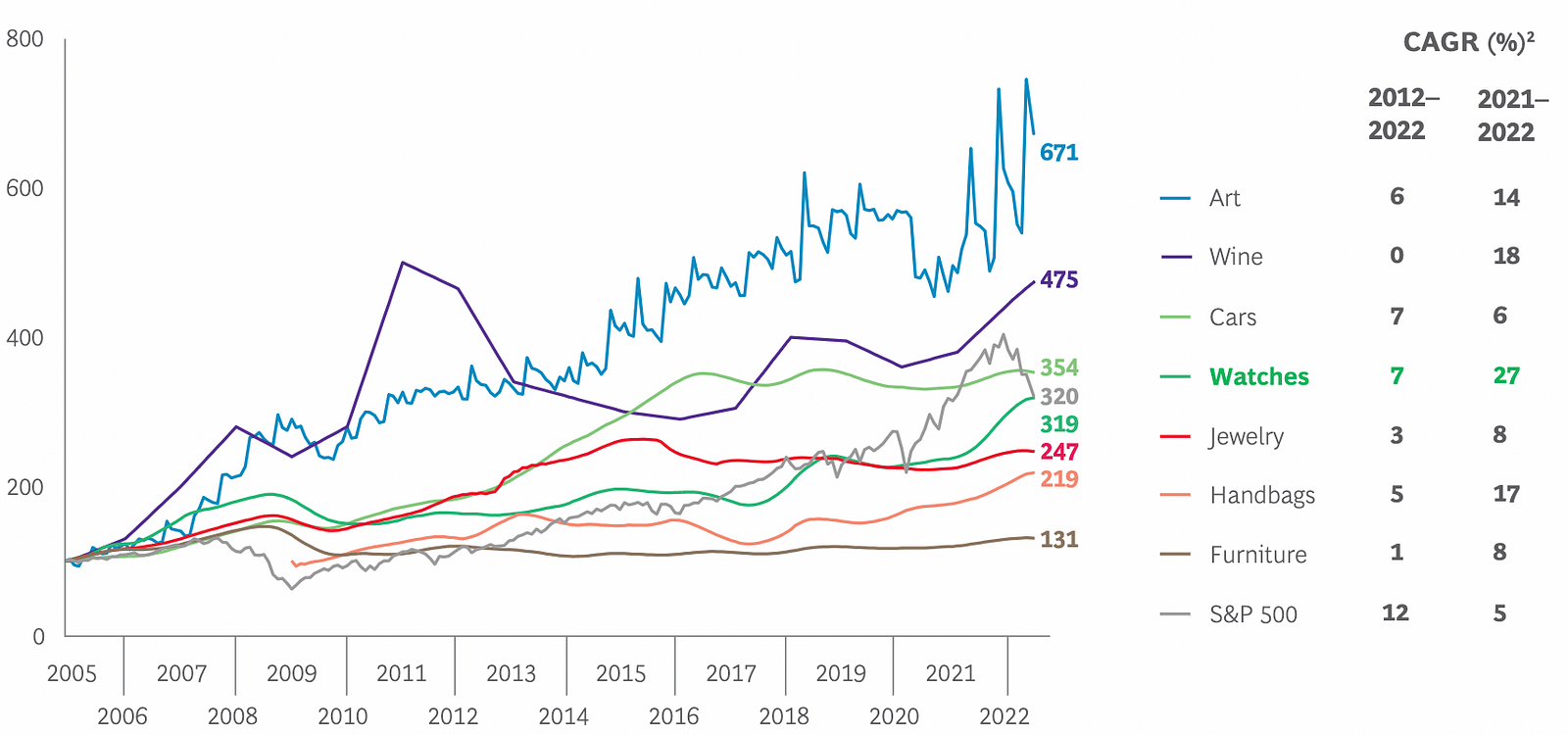

The next chart by BCG show how among alternative assets, watches have demonstrated consistent growth in the last 10 years.

Returns and Performance comparison amongst alternative assets from BCG Report: Luxury Preowned Watches, your time has come

Returns and Performance comparison amongst alternative assets from BCG Report: Luxury Preowned Watches, your time has come

One major reason that the secondary market has grown so much is that consumers seeking investment opportunities are gravitating to it. BCG reported that 54% of Gen Z and young-Millennials increased their spending on watches from 2021, specifically mentioning (1)increased ease of buying/selling and (2)investment opportunities, as their top reasons. Also, 66% said that the anticipated retained value or value growth of the watch influenced their decision to buy.

Although values fluctuate like with any other asset, there is a rising confidence overall in this emerging market and all these figures are an indication of the positive momentum in the watch industry despite the worldwide economic recession.

Conclusion: Are Watches an Investment Asset?

It does seem that the allure of wristwatches as investments is multifaceted. Watches are, for some, timekeeping pieces of art and engineering marvels while for others, they are just a lucrative investment or a symbol of status that tend to increase in value.

Our opinion: Even though watches do not generate value or cash flow on their own, many factors allow us to argue their categorisation as a non-traditional investment asset.

Leave a comment

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.